China’s multinational manufacturing conglomerate BYD and the U.S. powerhouse Tesla, who jointly accounted for 30% of the worldwide electric vehicle (EV) market between January and May 2024, are expected to cement their leading positions as the market continues to rapidly grow.

The relentless rise of BYD

In the first half of 2024, BYD delivered 726,153 BEVs, and 880,992 PHEVs. In 2024, the Chinese auto giant wants its average growth rate to exceed 20%.

With a reported 145,000 EVs sold this August, the Chinese automaker reached a milestone of 1 million EV sales in 2024. However, most of this increase was driven by PHEVs, with more than 222,000 units being sold, up 73% from August 2023.

With a reported 145,000 EVs sold this August, the Chinese automaker reached a milestone of 1 million EV sales in 2024. However, most of this increase was driven by PHEVs, with more than 222,000 units being sold, up 73% from August 2023.

With its competitive pricing strategy, BYD has shaken up the industry and attracted a wide range of customers by positioning its PHEVs as less expensive alternatives to internal combustion engine (ICE) vehicles.

Tesla’s performance

With sales of over 625,000 vehicles between January and May of 2024, Tesla took 11% of the EV market, demonstrating its continued prominence in the industry.

Although the company faced certain challenges earlier in the year, which resulted in an 8% year-on-year decrease in sales, May 2024 results offered some hope.

The months ahead will be crucial for the company’s efforts to recapture its growth trajectory and hold onto its top spot in the BEV market.

The months ahead will be crucial for the company’s efforts to recapture its growth trajectory and hold onto its top spot in the BEV market.

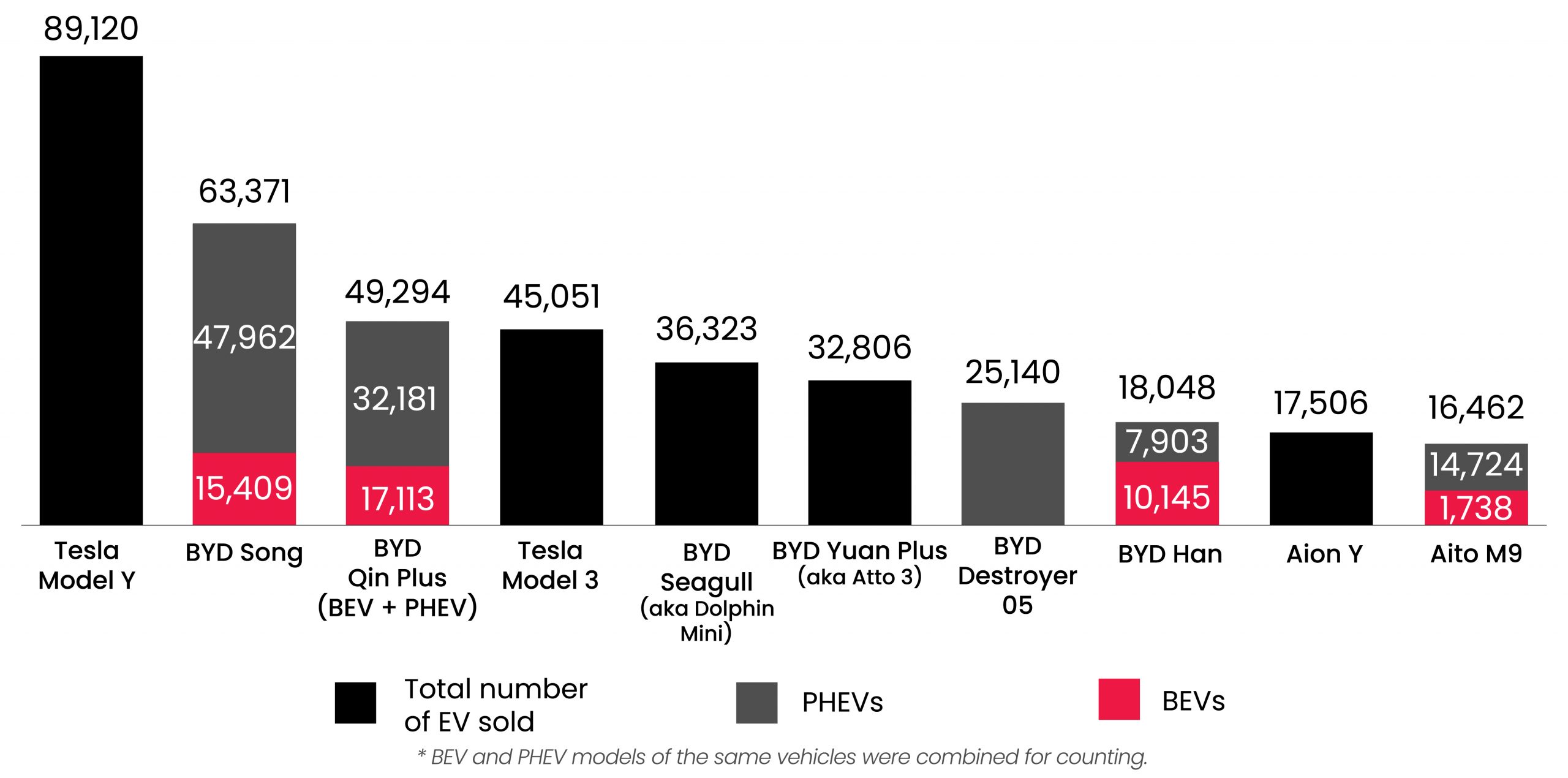

Most popular models in May 2024

May saw 89,000 new registrations of the Tesla Model Y, making it the best-selling plug-in vehicle globally, despite a year-on-year sales decrease of 6%.

The second and third most popular EV models globally were BYD’s Song (63,371 units sold) and BYD’s Qin (49,294 cars sold). Overall, the top 10 list of most popular EVs includes eight Chinese models, of which six were manufactured by BYD.

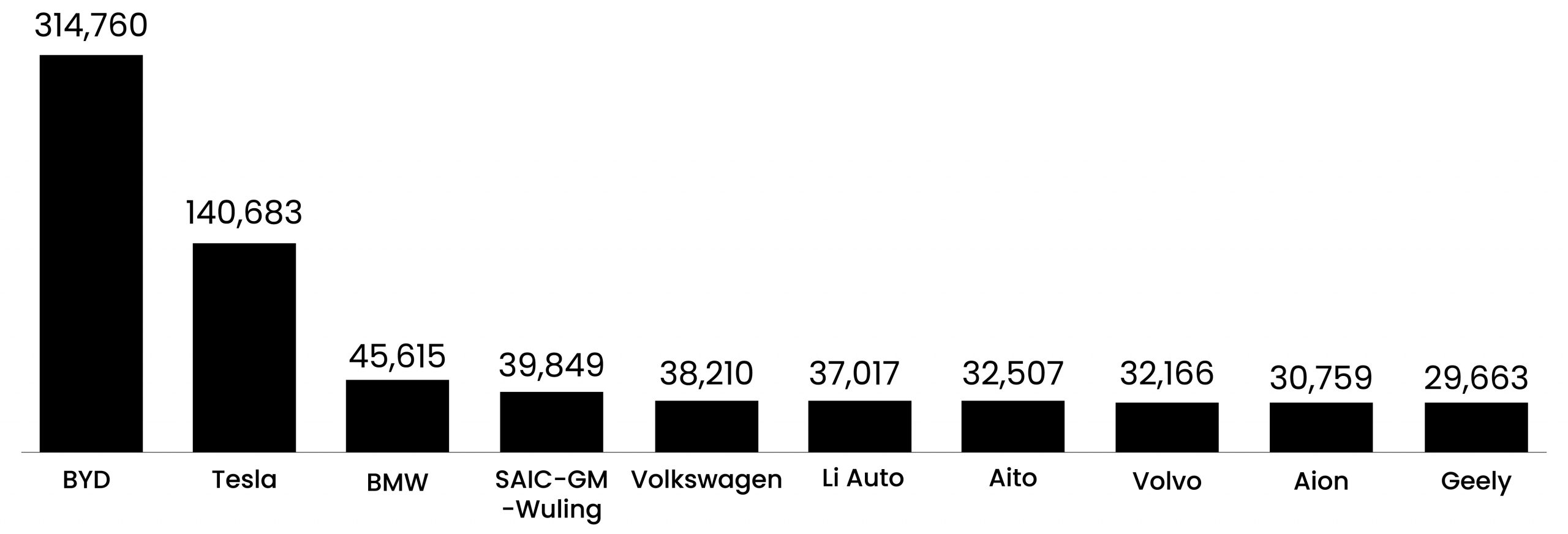

Top 10 brands as of May 2024

Top 10 brands as of May 2024

As of 2024, BYD stands as the only brand that has sold over a million plug-in hybrid and battery-electric vehicles combined. For electric vehicles, Tesla continues to be the best of the rest. For many, BMW’s position in third place comes as something of a surprise. Here is the data for brands that sold the most vehicles in May 2024:

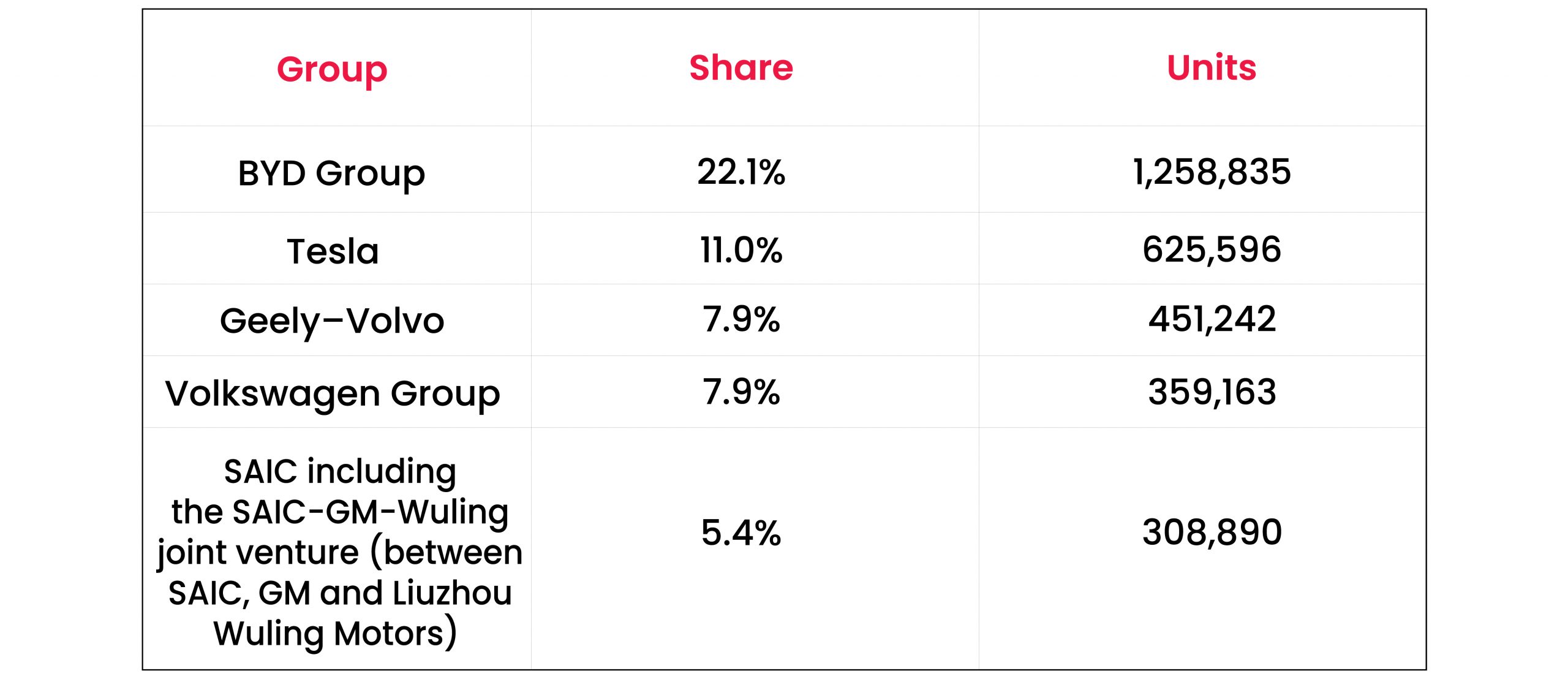

The January-May data on the top five automotive groups by share in the plug-in looks as follows:

European EV market outlook and its challenges

European EV market outlook and its challenges

According to a McKinsey survey conducted among more than 15,000 consumers in France, Germany, Italy, and Norway, 38% of non-EV owners would like to purchase an electric car.

Of those potential customers, slightly less than half intend to purchase a BEV, with the remainder opting for a PHEV.

22% of respondents were skeptical about EVs. The major reasons include:

- Purchase price

- Insufficient driving range

- Battery lifetime

- Fear of increases in electricity prices

- Inadequate charging infrastructure

It is therefore no surprise that this market is of significant interest to EV producers. However, local giants such as BMW and Volkswagen are apparently struggling to stand their ground as EVs from China cause serious challenges in the marketplace.

In September 2024, Volkswagen announced that it was considering closing manufacturing plants in Germany to further reduce costs in the face of growing competition from the East.

However, German automaker BMW remains a major player in this market.

The recent McKinsey report stated that European consumers remain wary, particularly regarding the quality of vehicles of unknown brands, which is one of the reasons why BMW remains a major player.

The recent McKinsey report stated that European consumers remain wary, particularly regarding the quality of vehicles of unknown brands, which is one of the reasons why BMW remains a major player.

To help the domestic car manufacturing industry, EU authorities have recently proposed a significant increase in import tariffs from 19% to 46.3% on Chinese BEVs entering the EU which could hinder the expansion of Chinese automobile firms in the region.

Remarkably, 19% of European EV owners are considering going back to driving ICE cars.

Final word

The rapidly evolving global EV market, in which Chinese manufacturers are gaining traction, promises to come to an exciting conclusion this year.

With 17 million EVs predicted to be sold by the end of 2024, established titans like Tesla and BMW will face increasing competition, and how European customers perceive Chinese entrants may have a lasting impact on the sector.

Suggested reading:

Enhancing Crisis Management Strategies with Expert Networks

Fintech Ecosystems: Future Trends and Expert Networks Impact

The Role of Expert Networks in Navigating the Real Estate Industry

Share to