Real estate is a critical component of the global economy. Land and the constructions upon it for residential, commercial, and industrial purposes provide homes, opportunities for the population to generate income, and businesses to conduct their economic activities, such as operating manufacturing or logistic facilities as well as retail locations.

Real estate yields a return on investment through appreciation in value and rental income generation. Listed entities involved in real estate, such as Housing Starts in the U.S., are often considered to be key economic indicators.

Real estate is also commonly used as an inflation hedge in the investment portfolios of institutional investors, public enterprises, and private equities. This is because, in general, real estate has less volatility than other types of investments, which is why it is highly attractive to investors who often use expert networks to navigate the complexities of real estate deals.

Real estate market statistics

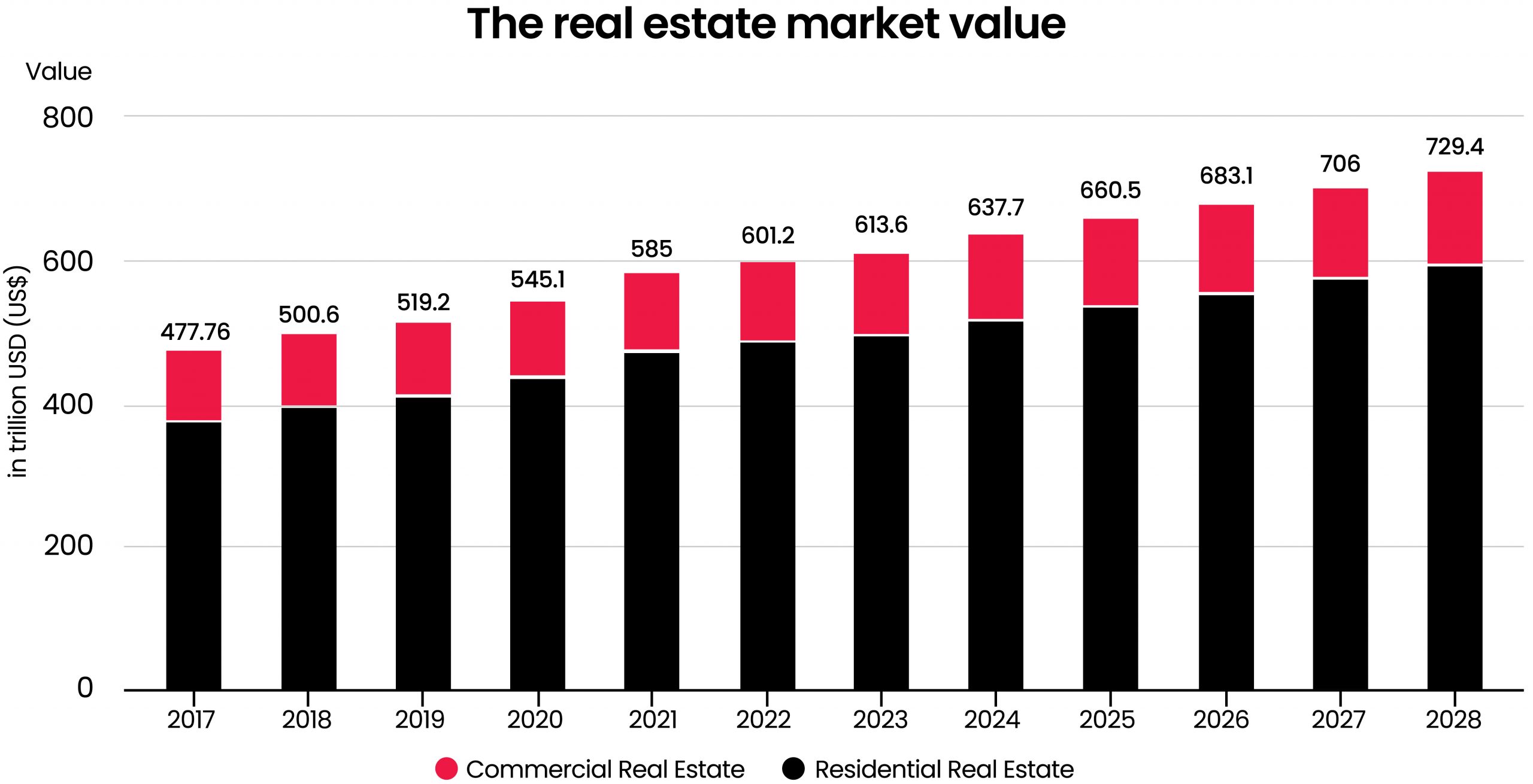

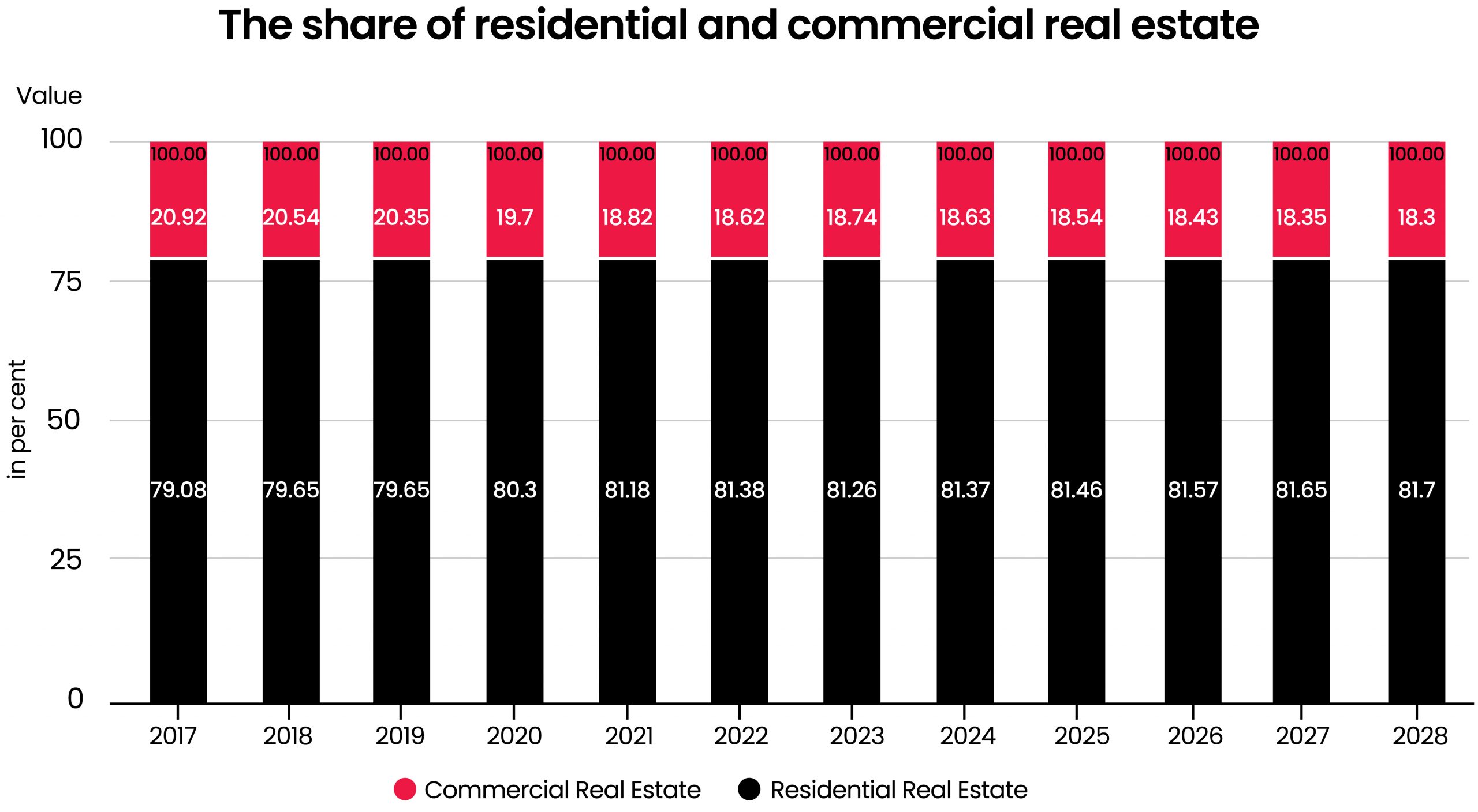

The global real estate market expanded rapidly in 2023, exceeding forecasts and demonstrating its stability in the face of changing economic conditions.

The projected growth for the sector is 3.41% per year (CAGR 2024–2028), with the market size expected to reach US$729.40 trillion in 2028.

The largest real estate markets worldwide are in the United States, China, India, Germany, and Japan. In the U.S., a newly built house in 2023 cost roughly US$427,400. The Northeast region of the country had the most expensive homes, with prices varying widely among other regions.

China’s residential real estate market was worth US$113.5 trillion in 2023 and experts anticipate that this will exceed US$132.8 trillion by 2028.

The role of expert networks in the real estate market

Expert networks like RightAngle can offer invaluable insights to businesses seeking to invest in real estate by facilitating connections between companies and industry experts who possess extensive knowledge in this field.

Thus, stakeholders interested in obtaining valuable information can increase their knowledge to improve their decision-making and strategic planning.

Initially, expert networks were used primarily in the management consulting and financial services industries. However, in real estate, where the complexities of transactions and developments require expert counsel, their involvement gradually increased after their value became obvious. They now provide a variety of services, such as strategic planning and market analysis.

Market analysis

Expert networks can help to identify individuals with exclusive knowledge who can provide forecasts of market trends and comprehensive analysis.

Examining data, economic indicators, and demographic swings in real estate is crucial in terms of market analysis. Using insight from subject-matter experts, found through expert networks, investors can improve their predictions of property values, rental rates, and market trends.

By getting in touch with expert networks and tapping into the extensive knowledge of market dynamics provided by professionals in the field, the chances of identifying emerging opportunities in undervalued or developing neighborhoods greatly increase. This information enables investors to take advantage of prospective high-return assets before the rest of the market does.

Risk evaluation

Real estate investments involve inherent risks such as market volatility, which, although often at low levels is still persistent, changes in regulation, and economic uncertainty.

Contracted experts can help to evaluate these risks by providing a comprehensive analysis that enables investors to limit potential losses and successfully navigate any uncertainties.

In addition, since due diligence plays a crucial role for real estate investors, the professionals found by expert networks for specific projects can provide extensive evaluations of properties, including structural inspections, market position, and any legal difficulties, to ensure more secure and sound investments.

Strategic planning and execution

Real estate developers can leverage expert networks to assess project viability prior to starting a new project. Experts can evaluate variables such as competition, market demand, location, and financial projections, which can assist developers to refine project plans and optimize the project’s results.

Companies looking to expand into new geographic regions can benefit from the experience of local professionals. Their experience can facilitate an easier entry, from understanding regulatory requirements to forming essential partnerships.

Leveraging technology

By using technology in the real estate industry (known as property technology, PropTech for short), experts can help stakeholders to implement innovative solutions such as virtual tours, AI-driven analytics, and smart building technologies which, in turn, can improve efficiency and customer experience.

Popular platforms such as Zillow and Redfin are examples of PropTech that assist prospective renters and homebuyers in their real estate searches by providing tools and resources related to buying and financing a home.

Final word

Expert networks are extremely valuable assets for the real estate industry, connecting stakeholders with experts who have specialized knowledge and can offer workable solutions and strategic insights. Real estate stakeholders can maximize their investments, make well-informed decisions, and confidently navigate through the market’s complexities by utilizing the knowledge of professionals recruited by expert networks.

Suggested reading:

How Does RightAngle Ensure Tailored Expert Support for Clients?

Fintech Ecosystems: Future Trends and Expert Networks Impact

Key Expert Network Trends in 2024: Insights from RightAngle Global

Share to