The financial technology industry, or fintech, has progressed at an exponential pace over the last ten years. The technological advances made by fintech companies have enabled the economies of developing nations to provide a plethora of services and possibilities to clients.

The number of digital platforms that enable users to pay, make investments, budget, and undertake many other financial operations has therefore increased dramatically, creating an ‘ecosystem’ of fintech companies that consumers are free to choose from.

The next period of fintech development will be characterized by several trends that could significantly influence the industry’s future. Let’s check out these trends and the role of Expert Networks in the fintech industry’s ongoing development.

What is the Fintech Ecosystem?

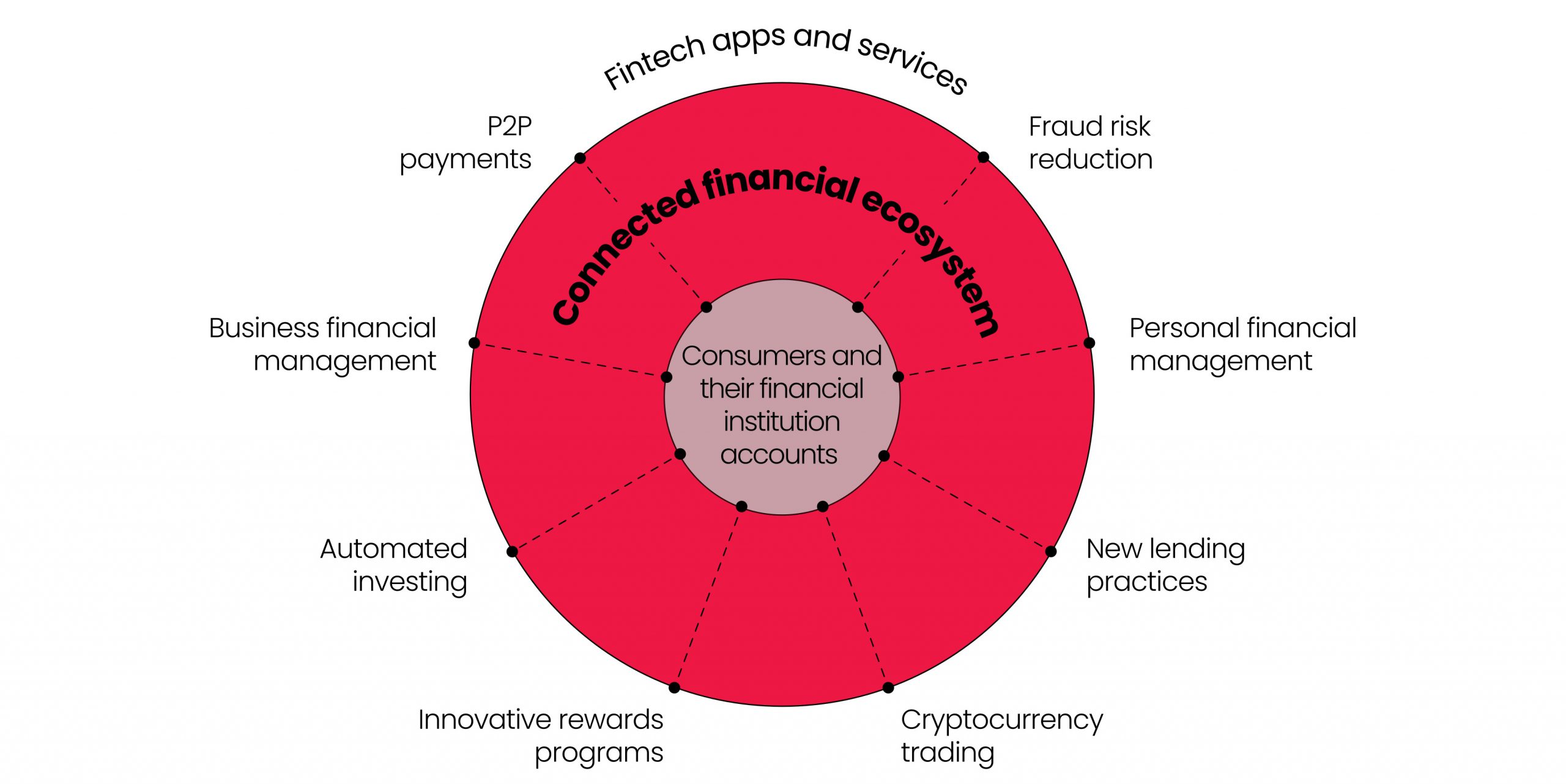

The fintech ecosystem is a combination of banks, fintech firms, applications, and users that all together constitute the financial system.

Despite banks having served as the main source of financial products and services throughout history, today, the interconnected ecosystem features fintech firms that are collaborating with banks to provide simple ways to manage expenditures, apply for a mortgage, and even make investments in assets, including cryptocurrency.

The numbers behind the financial technology industry show that it is still growing across the globe. According to the Future of Global Fintech, the primary engine of this growth is the increasing demand for financial services from customers.

The numbers behind the financial technology industry show that it is still growing across the globe. According to the Future of Global Fintech, the primary engine of this growth is the increasing demand for financial services from customers.

By 2026, the global fintech market is expected to be valued at an astounding US$324 billion, with a compound annual growth rate of 23.41% from 2021 to 2026.

Top Three Trends of the Fintech Ecosystem

With the evolution of the fintech ecosystem, new trends powered by consumer behavior are being witnessed. Here are some that are worth following:

1. Incorporating fintech into open finance

At one point, a key development in fintech was the concept of ‘open banking’—the practice of providing financial account information to third-party fintech apps that allowed banks to offer their customers access to a whole new range of financial services.

Now, open finance is the next step – in addition to banking, it offers additional features and more personalized financial products and services. It goes beyond banking to build a more interconnected financial system.

By offering people more control over their financial data and opening up access to a larger variety of financial services from different sources, open finance seeks to promote increased autonomy for consumers.

2. Increasing the interconnectivity within the financial system

Because open finance extends financial access beyond bank accounts, in the near future a smoother connectivity between those accounts and apps could be seen.

Think about how the financial ecosystem operates on a mobile device at the moment: one app for banking, another for P2P payments, a third for investing and so on. Our financial life may undergo a complete ‘digital transformation’ if these operations are connected in the future.

Fintech applications within the ecosystem could be able to improve people’s lives even further once they are better interconnected with each other.

3. AI-powered fintech ecosystem

Modern consumers anticipate that artificial intelligence will have its place in fintech, hoping it will change the sector within the next five years. Here’s how it can do so:

- AI-driven intelligent chatbots can offer 24/7 customer support for a variety of financial inquiries.

- AI systems can help financial institutions to prevent fraud by recognizing suspicious behavior in real time.

- AI can leverage massive amounts of data to evaluate credit risk with higher accuracy, allowing fintech firms to extend credit to a wider spectrum of clients.

The Impact of Expert Networks on Fintech Ecosystems

Expert Networks such as RightAngle can link companies with verified industry experts who can offer insights to help to navigate complex markets.

Fintech companies can gain a competitive edge and ensure they are well-informed and strategically positioned by leveraging these connections. Let’s examine the possible impact of expert networks on fintech ecosystems.

Expert Networks provide invaluable assistance to their clients, including management consulting firms, by offering insights into the fintech ecosystem and identifying potential areas of opportunity.

Improving Decision-Making

The fintech industry boasts fast technological advances and undergoes frequent regulatory changes which is why having prompt access to expert opinions can be invaluable. Expert Networks connect companies with seasoned professionals who can provide fintech companies with insights that can help them to make informed decisions about product development, market entry, compliance, and more.

Driving Innovation

Fintech companies can discover fresh perspectives and identify emerging trends by establishing connections with thought leaders and pioneers in the fields of technology and finance.

Access to state-of-the-art knowledge allows businesses to innovate more quickly and with a higher degree of effectiveness, increasing the confidence with which they launch new products and services.

Navigating Complex Regulatory Landscapes

Financial regulations differ throughout various regions, and adhering to these can sometimes be challenging. Fintech companies can connect with lawyers, legal experts and even former law-makers through RightAngle. They can therefore seek assistance to maneuver through these complex environments and ensure their product development remains within legal boundaries.

Minimizing Risks

Fintech companies are exposed to a variety of risks, such as market fluctuations and cybersecurity attacks. They can devise effective strategies to mitigate and minimize these risks by consulting experts in risk management, cybersecurity, and financial markets.

RightAngle meticulously recruits experts for each project we undertake. Our clients invest in premium-quality information, unwavering compliance, and exceptional customer service. Get in touch with RightAngle right now to get your project started. We provide superior value at competitive rates.

Final word:

Expert Networks have an extensive range of influence on the fintech ecosystem, offering fintech companies the knowledge and connections they need to succeed, from improving decision-making and spurring innovation to navigating regulatory environments and reducing risks.

Suggested reading:

Trends in the Health Insurance Market. Insights and Case Studies

The Role of Expert Networks in Talent Acquisition and Management

Key Expert Network Trends in 2024: Insights from RightAngle Global

Share to